The expanded 5% deposit scheme launches 1st October — but smart buyers and investors know September is the golden window. With price caps lifted, no LMI, and unlimited places, demand will surge fast. Act now to secure finance, research suburbs, and lock in professional support before competition explodes. Those who prepare today will win tomorrow.

Read moreThe Expanded 5% Deposit Scheme: Why September Could Be the Smartest Month to Act

The countdown has begun. In just one month, Australia’s property landscape will fundamentally shift as the expanded First Home Guarantee scheme launches, offering unprecedented access to homeownership with just a 5% deposit. As someone who has guided countless buyers through market cycles since 2009, I can tell you this represents the most significant policy change in Australian residential property since the introduction of negative gearing reforms.

But here’s what most people aren’t talking about: the real opportunity isn’t just about the scheme itself—it’s about what smart investors and buyers can do in the next 30 days to position themselves ahead of the inevitable market shift.e next 30 days represent the golden window for investors and home buyers who want to get ahead of the surge of competition.

The Game-Changing Deposit Scheme Details You Need to Know

The expanded scheme, launching 1st October 2025, removes the previous constraints that limited its effectiveness. Gone are the income caps that previously excluded middle-income earners, and the scheme now offers unlimited places rather than the previous 50,000 annual allocation. Most significantly, property price caps have been raised to reflect current market realities—meaning buyers can now access properties up to $1 million in Sydney and $850,000 in Queensland with government backing.

This isn’t just an evolution of existing policy—it’s a revolution. When I started in this industry, first-home buyers needed 20% deposits or faced prohibitive Lenders Mortgage Insurance costs. Now, government backing eliminates LMI entirely while requiring only 5% down.

Why September is Your Golden Window to Maximise Deposit Scheme

Current market conditions present a unique convergence of factors that smart buyers can exploit before October’s policy implementation creates increased competition. Auction clearance rates across capital cities are sitting at their highest levels in over a year, with Sydney leading at 69.6% and Melbourne following at 67.9%. This indicates underlying strength, but we’re still in the calm before the storm.

Property prices have shown consistent but moderate growth—houses up 6.3% year-on-year to a national median of $1,219,208, with units increasing 4.6% to $688,852. The market has found its rhythm after the volatility of 2022-2024, creating predictable conditions for strategic entry.

Interest rates are showing signs of easing, with the Reserve Bank’s recent actions signaling a potential downward trend. This combination of stable prices, improving lending conditions, and imminent policy change creates what I call a “preparation premium”—the advantage gained by acting before everyone else catches on.

The Four Pillars of Pre-October Strategy

Pillar 1: Financial Preparation Beyond the Deposit

While the 5% deposit grabs headlines, experienced investors know the deposit is just the beginning. Smart buyers should have an additional 3-5% of the property value set aside for transaction costs—stamp duty, legal fees, building inspections, and immediate settlement expenses.

Calculate your true buying power now. A $800,000 property requires a $40,000 deposit under the scheme, but you’ll need another $30,000-40,000 for associated costs. Don’t let excitement about the low deposit blind you to the full financial picture.

Secure pre-approval from multiple lenders immediately. With over 30 participating lenders now offering the scheme, competition for the best rates and terms will intensify come October. Lock in your financing capacity while lenders are still competing for market share rather than managing overwhelming demand.

Pillar 2: Market Intelligence and Location Selection

The expanded scheme will create immediate demand pressure in previously affordable segments. Properties priced just below the scheme’s caps will likely see the most competition. Smart investors should identify locations where the scheme’s impact will be minimized—either at price points well below the caps or in markets where organic demand already drives sales.

Regional markets present particular opportunities. The scheme’s simplified regional access combines with ongoing urbanization trends and improved remote work acceptance. Consider locations within 1-2 hours of major cities where infrastructure development is planned but prices haven’t yet reflected this potential.

My analysis suggests Brisbane and Perth offer the strongest fundamentals heading into this policy change. Brisbane’s infrastructure investment cycle is creating genuine value-add opportunities, while Perth’s resource sector recovery is attracting population growth that will drive sustained demand.

Pillar 3: Property Type Strategy

Units and apartments will likely see the most immediate scheme impact, as they naturally fall within price caps across most markets. This creates both opportunity and risk. While competition will increase, the scheme’s focus on first-home buyers rather than investors means savvy investors can still find value by focusing on properties that appeal to long-term owner-occupiers rather than scheme participants.

Look for properties with unique characteristics that scheme users might overlook—unusual layouts that suit specific demographics, properties requiring minor cosmetic work, or locations with strong fundamentals but limited immediate appeal to first-home buyers.

Pillar 4: Due Diligence and Risk Management

September represents your last opportunity to conduct thorough market research without competing against scheme-fueled demand. Use this time to build comprehensive location knowledge, understand local supply pipelines, and identify properties that have been on market for 30+ days—sellers may be more negotiable before October’s demand surge.

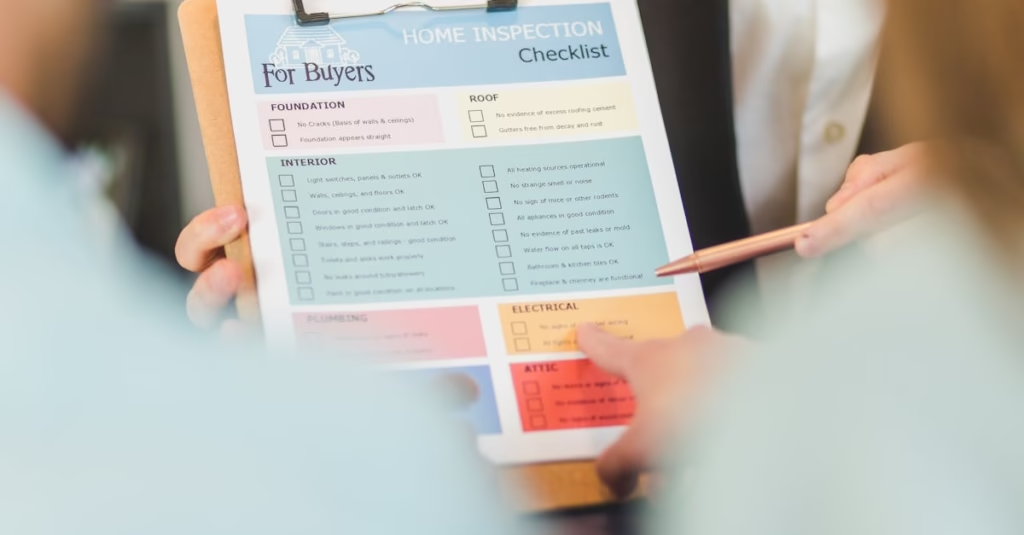

Engage professional services now. Building inspectors, lawyers, and buyer’s agents will see increased demand from October onwards. Securing these relationships and potentially pre-booking services ensures you won’t face delays when you find the right property.

The Hidden Risks Most Buyers Won’t Consider

The scheme’s success could become its own problem. Increased first-home buyer activity will push demand into segments traditionally dominated by upgraders and downsizers, potentially creating price inflation that offsets the scheme’s affordability benefits.

Government guarantee schemes also create moral hazard risks. Properties purchased under the scheme may face liquidity challenges if future policy changes affect guarantee transferability or if economic conditions force sales before sufficient equity is built.

Smart investors should also consider the scheme’s sunset risk. While currently unlimited, government programs can change with political cycles. Properties purchased under current conditions should have strong fundamentals independent of government support.

Practical Action Steps for the Next 30 Days

Week 1 (September 2-8): Financial Foundation

- Obtain pre-approvals from at least three scheme-participating lenders

- Secure written confirmation of your exact borrowing capacity

- Open high-interest savings accounts to maximize deposit growth

- Engage an accountant to optimize your tax position before purchase

Week 2 (September 9-15): Market Research

- Identify 3-5 target suburbs based on your budget and strategy

- Research recent sales, rental yields, and development approvals

- Visit at least 10 properties to calibrate your expectations

- Establish relationships with local agents in target areas

Week 3 (September 16-22): Professional Network

- Engage a buyer’s agent if purchasing outside your expertise

- Secure building inspection services and legal representation

- Connect with mortgage brokers specializing in government schemes

- Consider engaging a property manager if purchasing for investment

Week 4 (September 23-30): Execution Preparation

- Finalize your property criteria and non-negotiable requirements

- Practice your negotiation strategy and know your maximum price

- Prepare all documentation for rapid application processing

- Position cash for immediate deposit payment

The Long-term Investment Perspective

While the scheme creates immediate opportunities, successful property investment requires thinking beyond policy windows. The fundamentals driving Australian property demand—population growth, housing supply constraints, and urbanization—remain intact regardless of government programs.

Properties purchased strategically in September, before scheme competition intensifies, should benefit from both immediate policy-driven demand and longer-term structural factors. The key is identifying assets that would succeed with or without government support.

Consider this scheme as a catalyst rather than a crutch. Use the favorable financing to access quality properties in strong locations, but ensure your investment thesis doesn’t depend on ongoing government intervention.

Market Timing and Interest Rate Environment

Current economic indicators suggest we’re approaching an inflection point. With interest rates potentially trending downward in 2025’s second half and property prices showing sustained but moderate growth, the next six months could represent optimal entry conditions.

The Reserve Bank’s measured approach to rate adjustments, combined with inflation moderating toward target ranges, suggests financing costs may improve from current levels. However, this same environment will eventually attract more buyers to the market, potentially offsetting scheme benefits through increased competition.

Final Recommendations

The expanded 5% deposit scheme represents a genuine structural shift in Australian property accessibility, but its benefits will be maximized by those who prepare thoroughly rather than those who react once it launches.

Use September to build your foundation—financial, professional, and strategic. Identify opportunities that align with long-term value creation rather than short-term policy benefits. Remember that the best investments are those that succeed because of fundamental merit, with government support providing additional leverage rather than the primary rationale.

The property market rewards preparation, patience, and professional guidance. Those who use the next 30 days wisely will find themselves positioned to capitalize not just on October’s policy change, but on the broader opportunities that will emerge as Australia’s property market continues its evolution.

The clock is ticking, but for those who act strategically, time remains on your side.

Our approach is powered by the CLEAR Strategy; we help you find, negotiate, and secure the right property before the competition floods in.

Book your strategy session today and position yourself to win — before October changes everything.

show less