Australian property markets are surging again, with some suburbs gaining up to $562,500 in just three months following RBA rate cuts and policy boosts. From Cammeray’s $3.3m median to Brisbane’s rising lifestyle hubs, demand is outpacing supply nationwide. But while headlines scream record jumps, smart investors know not every surge is sustainable. The key is separating FOMO-driven spikes from fundamentals like jobs, infrastructure, and supply shortages. We help you cut through the noise, identify resilient growth markets, and build a portfolio designed for long-term wealth and financial freedom with a CLEAR Strategy.

Read moreAustralian Suburbs Where Prices Soared After the RBA’s Catalyst Cuts

Three interest rate cuts from the Reserve Bank of Australia (RBA) have reignited property markets in ways we haven’t seen in years. Combine that with the expansion of the first-home buyer scheme, and suddenly suburbs across Australia are adding hundreds of thousands in value within just 90 days.

In Cammeray, Sydney’s lower north shore, buyers witnessed a jaw-dropping $562,500 surge in just three months — proof that when money gets cheaper and borrowing capacity expands, demand floods back in.

But here’s the catch: not all suburbs will deliver sustainable returns. Investors and upgraders chasing these headlines risk overpaying unless they understand the drivers behind these price spikes and how to position for the next phase of the cycle.

Let’s break down what’s happening, where it’s happening, and what you should do if you’re serious about building wealth through property.

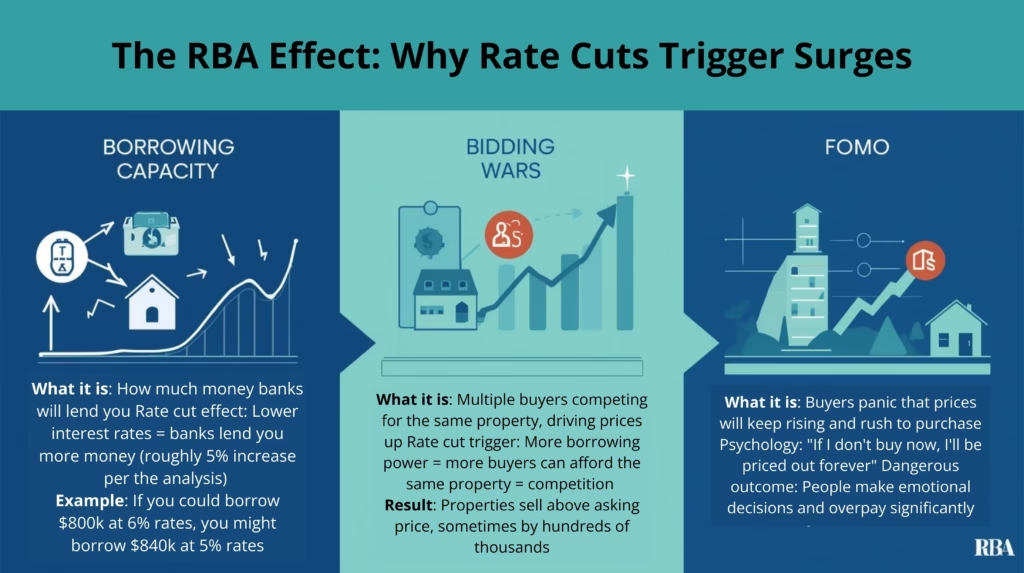

The RBA Effect: Why Rate Cuts Trigger Surges

When the RBA cut rates three times in 2025, borrowing capacity lifted by roughly 5% year-to-date. That sounds small, but in markets where supply is scarce and demand is emotional, it was rocket fuel.

Tighter listings met stronger borrowing power, sparking bidding wars and — in some cases — FOMO-driven premiums hundreds of thousands above guide.

Investor takeaway: Don’t just look at interest rates. Look at the supply. Falling rates + limited stock = instant price pressure. Look for guidance and work with professionals.

Cammeray: The $562,500 Case Study

Cammeray saw a staggering 20% lift in just 90 days. That’s not “normal” growth — that’s emotional demand colliding with scarce supply.

- Median price: $3.375 million

- Quarterly rise: +$562,500

- National average in same period: +2.3%

This isn’t just a prestige postcode story. It’s a warning. When borrowing power jumps, blue-chip suburbs absorb the excess demand first.

Investor takeaway: Cammeray shows what happens when scarcity meets money. Use it as a barometer, not a blueprint.

The FOMO Factor: Why Buyers Push Beyond Logic

Buyer’s agents on the ground are reporting one clear pattern: realistic vendor reserves, but buyers overshooting them.

Emily Wallace sums it up: “It’s not underquoting, it’s buyers driving competition.” With spring selling season underway, expect even more emotional bidding.

Investor takeaway: Don’t fight FOMO with FOMO. Stick to fundamentals: yield, infrastructure, growth cycles.

The National Picture: First Time in Years

Between April and June, every capital city recorded gains for both houses and units. That hasn’t happened in:

- 4 years for houses

- 2 years for units

This broad-based growth signals a cycle shift — and it’s not just Sydney. Brisbane, Adelaide, Perth, and regional hubs are in the game.

Investor takeaway: Momentum isn’t isolated. This is national — but it will play out unevenly across suburbs.

Top Performing Suburbs by State

The report flagged 36 postcodes with the fastest growth. A few standouts:

- NSW: Cammeray (+$562,500), Haberfield (+$300,000), Sans Souci (+$215,000)

- QLD: Banyo (+$127,500), North Ward (+$120,000), Bulimba (+$65,000)

- WA: City Beach (+$100,000), Lesmurdie (+$90,500), Scarborough (+$23,000)

- SA: Blackwood (+$88,500), Warradale (+$83,500), Plympton Park (+$50,000)

- VIC: Brunswick West (+$32,500), Beaumaris (+$17,000)

- ACT: Franklin (+$35,000), Kaleen (+$18,000)

Investor takeaway: Every state has growth pockets. Don’t just chase Sydney headlines.

The Triple Whammy Driving Growth

Economists describe today’s market as being hit by a “triple whammy”:

- Rate cuts – cheaper debt, higher borrowing power

- Policy tailwinds – expanded first-home buyer scheme (caps lifted Oct 1)

- Renewed confidence – improving economic outlook + spring listings

Investor takeaway: Cycles accelerate when fundamentals + sentiment + policy align. That’s where we are now.

Risk Warning: Are These Price Jumps Sustainable?

Not every $500,000 surge sticks. Some suburbs overcorrect when FOMO cools. The question is: which postcodes will hold gains through 2026 and beyond?

The answer lies in fundamentals: jobs, infrastructure, and supply. Without those, today’s $500k lift could become tomorrow’s stagnation.

Investor takeaway: Don’t confuse a sugar hit with long-term growth.

Where Savvy Investors Should Look

While prestige suburbs make headlines, the smart money looks elsewhere:

- Suburbs within 10–15 km of job hubs (hospitals, universities, airports)

- Regional centers with diversified economies (Townsville, Newcastle, Geelong)

- Lifestyle markets where affordability is still intact (Sunshine Coast hinterland, Adelaide metros)

Investor takeaway: Follow jobs and migration, not just news headlines.

How to Position in 2025–2026

Here’s how sophisticated investors are navigating this cycle:

- Short-term: Target suburbs just entering growth, not already peaking

- Medium-term: Use SMSFs and trusts for tax-smart diversification

- Long-term: Focus on scarcity-driven locations that ride infrastructure upgrades

Investor takeaway: Your structure is as important as your suburb.

The Bottom Line: Action with Strategy

Australian property isn’t cheap. But with the right lens, this market offers both growth and resilience.

Yes, Cammeray jumped $562,000 in 90 days. But your best move isn’t copying that play. It’s building a portfolio across different markets, cycles, and asset types to secure long-term wealth.

We help investors cut through FOMO and focus on fundamentals.

Our CLEAR Strategy ensures you:

- Identify high-growth suburbs with staying power

- Avoid overpaying in FOMO-driven markets

- Leverage SMSFs and structures to invest smarter

- Build a multi-property portfolio designed for financial freedom

👉 Book your free property strategy session today and position yourself before this cycle runs away from you.

show less