Australian households face budget pressures, but most borrowers remain resilient. With low arrears, strong jobs, and buffers in place, the property market is stable. For buyers, that means no sudden crash but clear opportunities. For investors, it’s time for precision: target job-rich hubs, balance yield with growth, and use smart structures like SMSFs to stay ahead.

The latest insights from the Reserve Bank of Australia (RBA) show us a mixed picture: household budgets are stretched, but most borrowers remain surprisingly resilient. For home buyers and property investors, this isn’t just background noise. It’s a signal of where opportunities — and risks — are emerging.

Let’s break it down in simple terms and then translate what it means for your buying or investing journey.

Read moreHouseholds Budget: Stretched But Not Broken

Australian households have been squeezed by three big factors since 2022:

- Inflation – higher everyday costs.

- Interest rates – bigger mortgage repayments.

- Taxes – higher take from pay packets until Stage 3 tax cuts.

That combination dragged real disposable incomes down through 2022 and 2023. Simply put, families had less money left after paying bills, loans, and tax.

The good news? Things have stabilised in 2024–25. Inflation is easing, tax cuts kicked in, and incomes are holding steady. Real disposable income per capita is now back around pre-pandemic levels.

Takeaway: Household pressure is real, but the system isn’t collapsing. This matters because sustained financial stress often triggers forced sales or arrears — and we’re not seeing that at scale.

Mortgage Stress: Who’s at Risk?

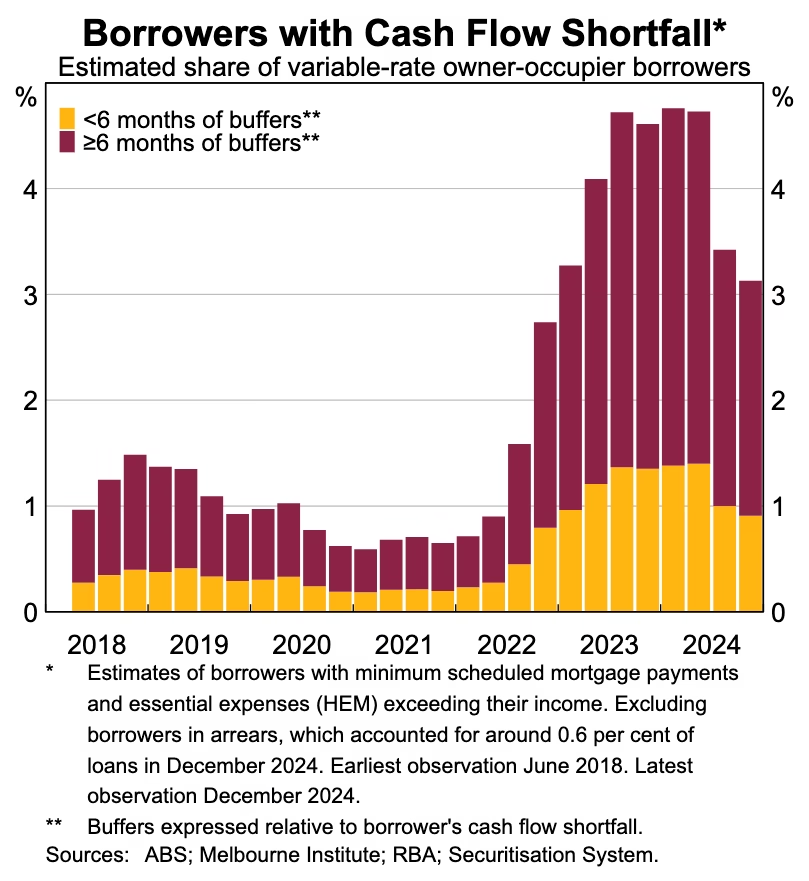

Only about 3% of borrowers are in cashflow shortfall (struggling to cover expenses plus mortgage). Of those, just 1% have both a shortfall and no savings buffer — the group most at risk of falling behind.

Yes, stress levels are higher than pre-pandemic, but far below historic peaks. Loan arrears and insolvencies are sitting around pre-2020 levels.

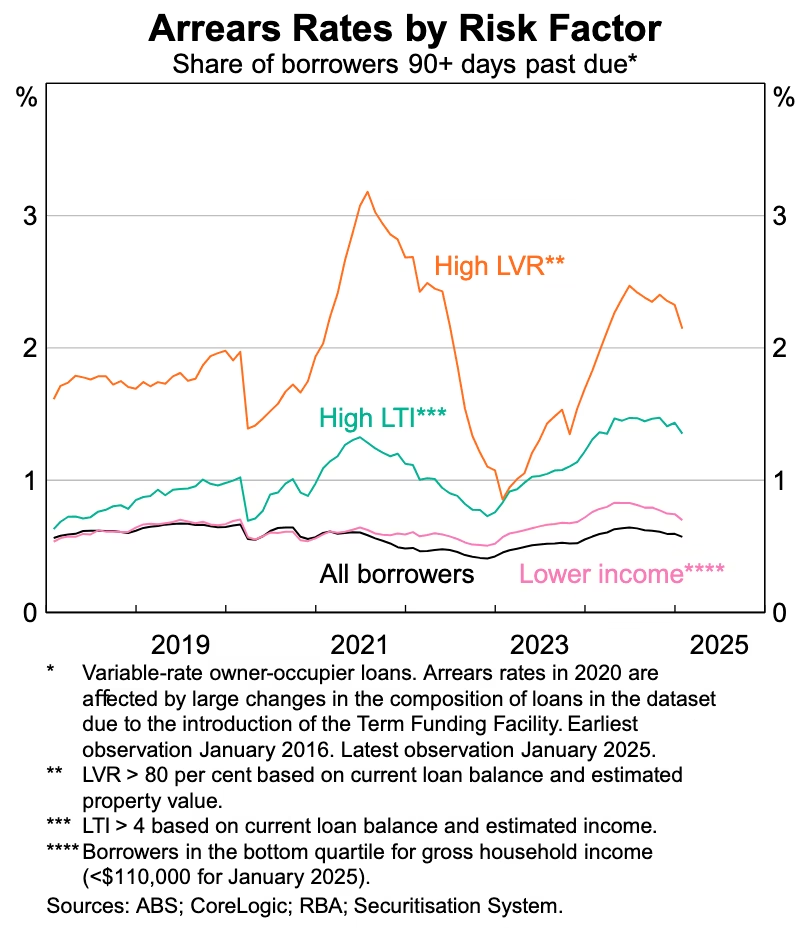

So, where’s the risk concentrated?

- Highly leveraged borrowers – big loans relative to income or property value.

- Lower income households – thinner cash buffers, less flexibility.

- Victoria – higher loan sizes, weaker jobs market, younger households with newer debt.

Takeaway: Stress is contained but localised. As an investor, you don’t avoid these households — but you need to know where risk concentrates so you can price it in and diversify.

Jobs Are Holding Everything Together

The single biggest factor protecting households? Jobs.

Unemployment remains near record lows, around 3–4%. Many households under pressure have managed by:

- Picking up extra shifts or overtime.

- Switching into higher-paying jobs.

- Benefiting from wage rises in certain industries.

This explains why arrears haven’t spiked. As long as employment stays strong, most borrowers can juggle higher repayments.

Investor Translation: Strong employment equals stable rental demand. Tenants with jobs pay rent. Owner-occupiers with jobs pay mortgages.

Buffers and Equity: The Hidden Safety Net

Australian households built up significant savings buffers during COVID. While many have drawn them down, most borrowers still hold larger buffers than pre-2020.

Meanwhile, fewer than 1% of households are in negative equity (owing more than their home is worth). Even in a hypothetical 30% house price drop, 9 out of 10 borrowers would still hold positive equity.

That’s a huge backstop for financial stability. It means households can sell if needed, rather than defaulting.

Takeaway: The floor is strong. Don’t expect a GFC-style wave of forced sales.

Regional Differences: Why Location Still Rules

Not all states are equal.

- Victoria is the hotspot for arrears and stress, with higher debt levels and thinner buffers.

- WA, QLD, SA households are showing more resilience, thanks to stronger economic conditions and population inflows.

- Tasmania also looks vulnerable, with weaker price growth and smaller equity cushions.

Investor Translation: Diversification matters. Don’t just look at one state or city. Spread risk across markets with different economic drivers.

The Bigger Picture: What’s Next for Households

Here’s the forward outlook:

- Cashflow relief is coming: Stage 3 tax cuts + declining interest rates = more breathing room.

- Real wages will grow: Incomes are expected to rise faster than inflation.

- Cashflow shortfalls will shrink: The RBA projects the share of borrowers struggling will fall below 2% by 2026.

But here’s the risk: if rates fall too quickly, we could see a new wave of risky borrowing, speculative behaviour, and another rapid house price upswing.

Takeaway: Don’t get caught in the hype cycle. Stick to fundamentals: buy in strong locations, with owner-occupier appeal, and balanced rental yields.

What This Means for Home Buyers

If you’re a first-home buyer or upgrader, here’s the practical read:

- Affordability remains tight, but it’s stabilising. Waiting for a “crash” is unrealistic.

- Competition is patchy: Some states are more stressed than others, giving you entry points.

- Tax cuts + lower rates will improve borrowing power in 2025–26.

Buyer Strategy: If you’ve been priced out of Sydney or Melbourne, look north and west. Regional hubs in QLD and WA, supported by jobs growth and population inflows, remain attractive.

What This Means for Investors

For investors, the signal is clear:

- Focus on employment hubs – job security means rent security. Hospitals, logistics, and education precincts are magnets.

- Balance growth and yield – yields may flatten slightly, but they’re still above average in regional centres.

- Use structures smartly – SMSFs and trusts remain valuable for tax efficiency and asset protection.

- Don’t over-leverage – buffers and discipline are what separate resilient investors from risky ones.

Investor Strategy: This is a precision market, not speculation. Get granular. Focus on suburbs where demand is undersupplied, and buy properties with clear owner-occupier appeal.

The CLEAR Strategy Lens

This is exactly where our CLEAR Strategy comes into play:

- Clarity: Cut through the noise. Household stress headlines don’t equal a market collapse.

- Leverage: Use smart finance, but don’t stretch. Protect buffers.

- Expertise: Look beyond the data — understand the story behind household resilience.

- Assurance: Diversify across states to reduce localised risks.

- Results: Build a portfolio that grows steadily, rather than chasing quick wins.

Final Word: Pressure Creates Opportunity

Yes, households are under pressure. But the data shows they’re holding up remarkably well. For home buyers, that means no sudden affordability miracle — but also no collapse in values. For investors, it means opportunities are there if you know how to read the signals and act before the broader market catches on.

As always, the market rewards those who prepare, not those who panic.

Your Next Step

If you’re planning to buy in 2025 — whether it’s your first home, an upgrade, or an investment — now is the time to build your strategy.

We help clients cut through the noise, identify high-performing opportunities, and structure their purchases for long-term wealth.

📞 Book your strategy session today. Let’s make sure you’re not just buying property — you’re building a financial future that lasts.

show less