Introduction: Why the Market Feels Impossible — Until You Look Closer

If you’re a home buyer or property investor in 2025, chances are you’ve felt the sting of affordability. Prices are rising, rates remain high, and homes in premium suburbs are sitting longer on the market.

But here’s the surprising shift: in affordable, high-demand suburbs, properties are selling in as little as 7–12 days.That’s less than half the national average.

In this deep dive, we’ll explore the fastest-selling suburbs in Australia, why they’re attracting buyers, and what this means for your next property move.

show moreWhy Property Still Outperforms in 2025

Despite affordability challenges, property remains the cornerstone of Australian wealth-building. The reasons are clear:

- Scarcity of supply: Listings remain low across capital cities.

- Strong migration: Population growth is fueling demand, especially in lifestyle and affordable hubs.

- Rental pressures: Investors are chasing yield as rents rise in tandem with demand.

The result? Certain markets are boiling hot, even as others cool.

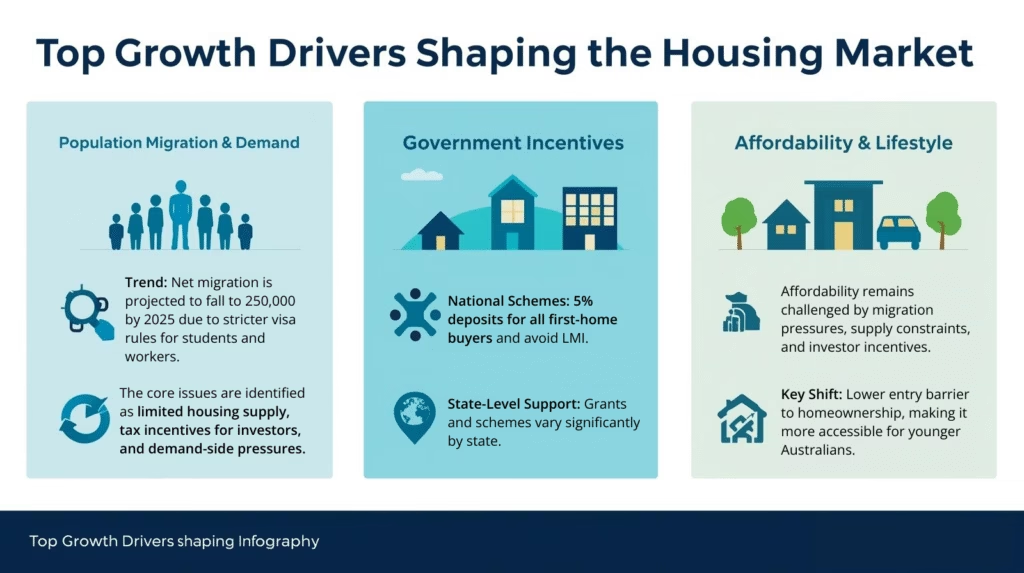

Top Growth Drivers Shaping the Housing Market

Population Migration & Demand

Interstate migration is changing the game. Buyers from Sydney and Melbourne are moving to more affordable cities like Townsville, Hobart, and parts of Perth.

Government Incentives

First-home buyer schemes, stamp duty concessions, and expectations of rate cuts are giving new buyers confidence to enter the market.

Affordability & Lifestyle

Outer suburban belts and regional towns are attracting both families and investors, creating fierce competition.

Townsville Dominates Rapid Sales

Townsville is the undisputed leader in fast sales this year.

- Douglas (units): Selling in just 7 days

- Condon (houses): Selling in 9 days

- Prices: Have doubled since the pandemic

Why?

- Southern buyers are migrating north for affordability and lifestyle.

- Strong rental yields attract investors.

- First-home buyers compete for entry-level houses.

Caution: This growth may not be sustainable long-term. Affordability is already strained.

Sydney: Buyers Pushed West & South

Sydney’s affordability crisis is forcing buyers to outer suburbs.

Fastest Selling Suburbs:

- Jamisontown & Werrington County: 12 days

- Eagle Vale, Raby, St Helens Park, Ruse: 14–17 days

Growth Trends:

- Jamisontown: +6% over the past year

- South Penrith: +11% over the past year

Who’s Buying?

- First-home buyers chasing affordability

- Local families upsizing within the west and southwest

Melbourne: Affordable Southwest Suburbs Surge

Melbourne’s affordability relative to Sydney is pulling in buyers.

- Carrum Downs: Selling in 11 days

- Frankston North & Narre Warren: Strong activity under $750K

- Investor Interest: Sydney and Brisbane investors entering due to better yields

Why It Matters:

Previously overlooked suburbs are gaining recognition for strong rental returns and livability.

Perth: From Sizzling to Steady

Perth outer suburbs were selling in just 7 days a year ago. Now, conditions are normalizing, but demand remains strong.

- Wembley Downs & Mount Lawley: Biggest improvements in days on market

- Units: Inner suburbs see rising demand as affordability bites

- Price Growth: +49% since RBA rate rises began

Homes are still selling within 2 weeks in many suburbs.

Brisbane: Cooling But Not Cold

Brisbane is showing signs of cooling.

- Price Growth: +33% since RBA rate rises began

- Days on Market: Rising in most suburbs

- Bright Spot: Premium suburbs like Bardon are bucking the trend with reduced days on market

Tasmania: Recovery in Motion

Tasmania is staging a comeback after the post-2022 slump.

- Newnham (Launceston): Sales 63% faster than last year

- Austins Ferry, Rosetta & Geilston Bay: Houses selling twice as fast as a year ago

- Case Study: A 3-bedroom brick house in Newnham sold for $470,000

Prices remain below early 2022 peaks, but affordability and lifestyle appeal are driving recovery.

Regional vs Metro Trends

Regional Areas Heating Up

- Victoria: Geelong, Bendigo, Mildura

- Queensland: Bundaberg, Gladstone

- NSW: Bellingen

Metropolitan Trends

- Outer affordable suburbs dominate (Sydney west, Melbourne southwest, Perth inner units).

- Inner-city areas vary depending on affordability and supply.

Investment Insights

Where Smart Buyers Are Investing

- Townsville — rapid growth, but monitor sustainability.

- Melbourne’s Southwest — strong affordability play, solid rental returns.

- Sydney’s Outer West & South — consistent first-home buyer demand.

- Perth Inner Units — affordability shift boosting unit demand.

Market Risks & Cautions

- Townsville overheating: Affordability stretched.

- Rate sensitivity: Highly leveraged buyers may face challenges.

- Cooling capitals: Brisbane and Perth show normalization.

Future Outlook: What to Expect in 2025

Positive Signals

- Anticipation of interest rate cuts driving spring demand.

- Regional markets recovering faster than expected.

- Affordable suburbs remain red-hot.

Red Flags

- Affordability at its worst on record.

- Rapid price growth in certain regions unsustainable.

- Buyers may retreat if credit tightens further.

Strategic Insights for Buyers & Investors

- Geographic Arbitrage: Look beyond your local city; affordability hotspots are creating opportunity.

- Units Gaining Ground: Particularly in inner suburbs where house prices are out of reach.

- Regional Growth Story: Lifestyle + affordability = long-term resilience.

- Affordability Crisis: The #1 driver of demand and competition in 2025.

Conclusion: How to Use This Market Shift

Australia’s property market in September 2025 is a tale of two markets: ultra-hot affordable suburbs versus cooling premium areas.

For home buyers, the lesson is clear: look where affordability meets demand.

For investors, the opportunity lies in emerging suburbs with strong rental returns and regional recovery markets.

Next Step: If you want clarity on where to buy next — and how to balance affordability with growth potential — book your free strategy session today.

show less