Has property investing become a game only for the wealthy?

With prices rising and borrowing power tightening, many Australians feel like they’ve missed the boat. But here’s the truth — you haven’t.

The opportunity hasn’t disappeared. It’s simply moved.

In 2025, investors who understand where the money is flowing — and why — will create serious wealth. And right now, all signs point to Brisbane as the next major growth story.

Let’s break down the data, city by city.

show moreWhy Brisbane Outperforms Melbourne in 2025–2030

If you’ve been tracking the Australian market, you already know: Melbourne’s cooling. Brisbane’s booming.

But this isn’t just hype — it’s fundamentals.

Brisbane wins on 8 out of 9 key performance metrics for property investors, including infrastructure, jobs, migration, and growth.

| Category | Melbourne | Brisbane |

|---|---|---|

| Infrastructure | $55B (delayed) | $225B+ (fully funded) |

| Population Growth | 1.4% | 2.3% |

| Job Creation | Moderate | Strong (Olympics catalyst) |

| 5-Year Growth | 17.5% | 80% |

| Vacancy Rate | 2.1% | 1.1% |

| Rental Yield | 3.7% | 3.6% + higher growth |

👉 Verdict: Brisbane is the superior investment destination through 2030.

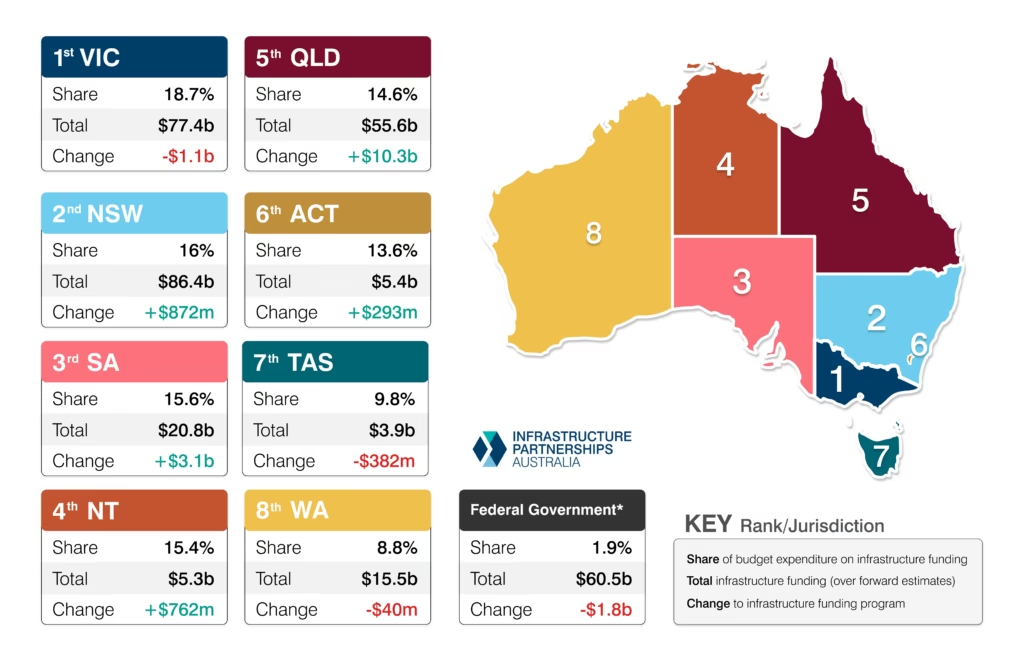

Infrastructure Spending: The 4x Advantage

Brisbane’s biggest edge? Government investment.

Over $225 billion is locked in for Queensland through 2027–28 — a mix of transport, housing, and renewable projects. The 2032 Olympics alone injects $7.1 billion in new venues and transit systems.

Compare that to Melbourne’s $55 billion (with multiple project delays) — and the difference is night and day.

Key Brisbane Projects:

- Cross River Rail ($7.8B, 2026 completion)

- Brisbane Metro (2025 launch)

- Sunshine Coast Rail Line ($5.5B, underway)

- Olympic Venues & Athletes’ Villages ($7.1B total)

💬 “Infrastructure is the foundation of long-term capital growth. Brisbane’s pipeline isn’t just larger — it’s transformational.”

👉 Investor Takeaway: Follow the cranes. Infrastructure drives jobs, liveability, and demand — the three pillars of property appreciation.

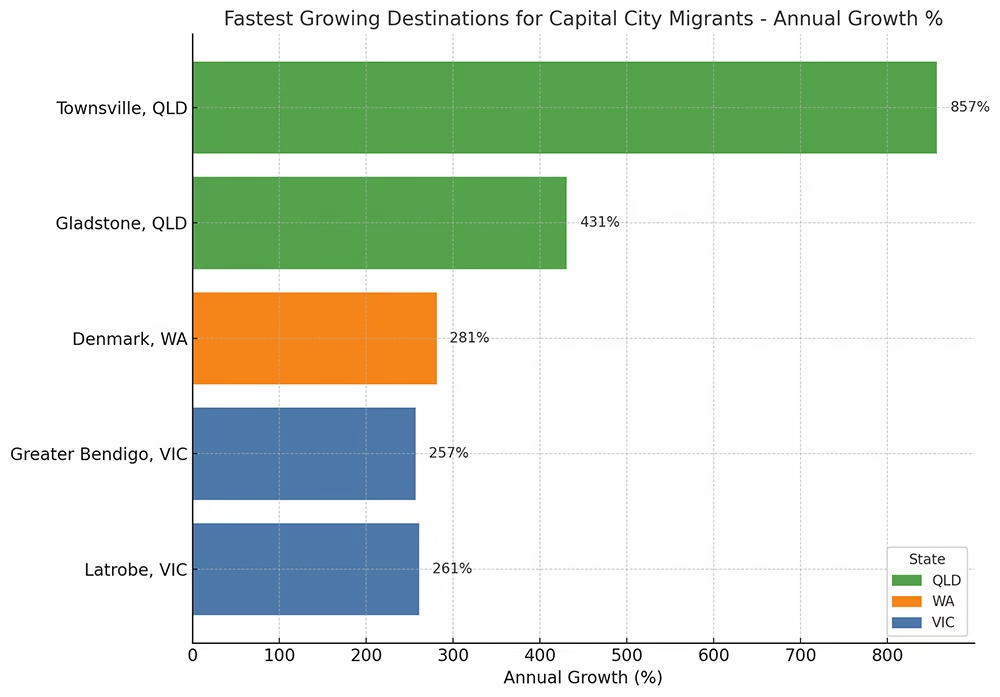

Australians Are Moving North — And It’s Not Stopping

Population growth is where property stories begin.

In the next five years, Brisbane’s population is set to grow 50% faster than Melbourne’s.

- Brisbane: 2–3% annual growth, fuelled by interstate migration and affordability.

- Melbourne: 1.3–1.4% annual growth, still recovering from lockdown-era outflows.

Australians are voting with their feet — chasing affordability, sunshine, and opportunity.

Top inbound regions: Logan, Ipswich, Moreton Bay, and Redcliffe — all forecast to outperform through 2030.

👉 Investor Takeaway: Follow the people, not the headlines. Population growth = rental demand + equity growth.

Job Creation: The Hidden Multiplier

Employment drives housing stability — and Brisbane is turning into a jobs engine.

The 2032 Olympics will generate tens of thousands of construction, tourism, and tech jobs, creating sustained housing demand through 2035.

- Queensland unemployment: 3.9% (tighter than Victoria’s 4.6%)

- Wage growth: +4.3% (QLD) vs 3.3% (VIC)

- Sectors booming: Health, Education, Professional Services, Tourism

Meanwhile, Melbourne’s job creation is still CBD-centric — leaving many suburban areas underemployed and underserviced.

👉 Investor Takeaway: Buy where people work, not just where they sleep. Brisbane’s diversified economy gives investors stability and upside.

Market Momentum: Numbers Don’t Lie

| Metric | Melbourne | Brisbane |

|---|---|---|

| 5-Year Price Growth | +17.5% | +80.1% |

| Median House Price | $953K | $977K |

| Median Unit Price | $629K | $688K |

| Vacancy Rate | 2.1% | 1.1% |

| 2025 Growth Forecast | 3.5–6% | 9–14% |

Brisbane’s market is driven by undersupply — with listings 31% below average and record demand for houses in the $700K–$1.1M range.

Melbourne’s market, by contrast, faces affordability caps and weak unit growth.

Investor Takeaway: Momentum matters. Brisbane’s trend line is still upward — Melbourne’s is plateauing.

What $1M Buys You in Each City

In Melbourne, $1M gets you a 3-bedroom home in Werribee or a unit in Brunswick.

In Brisbane, the same budget buys a renovated family house in Chermside, Stafford, or Camp Hill — all within 10km of the CBD and top schools.

| City | Property Type | Suburbs | Growth Outlook |

|---|---|---|---|

| Melbourne | Outer ring house | Cranbourne, Werribee | 4–7% p.a. |

| Brisbane | Middle ring house | Kedron, Nundah, Camp Hill | 8–12% p.a. |

👉 Investor Takeaway: The same budget builds more equity — and lifestyle — in Brisbane.

Lifestyle & Migration Synergy

Australians aren’t just chasing jobs — they’re chasing lifestyle ROI.

Brisbane’s appeal goes beyond numbers: better weather, bigger homes, outdoor living, and lower cost of living.

Post-COVID, that emotional shift has become structural.

“Lifestyle migration” is now a data-backed driver of capital growth — and Brisbane ranks #1 nationally for livability-adjusted affordability (REIA, 2025).

Investor Takeaway: Emotional value creates market resilience. People stay longer, pay more, and push prices higher in lifestyle-driven cities.

Where to Buy: Brisbane’s Investor Hotspots

Middle-Ring North (8–12% Annual Growth)

- Chermside, Kedron, Stafford, Nundah

- Close to CBD, schools, jobs, and infrastructure

Growth Corridors (10–15% Annual Growth)

- Springfield Lakes, North Lakes, Forest Lake

- Master-planned estates, family-friendly, affordable

Olympic Precincts (High-Upside Play)

- Woolloongabba, Coorparoo, Kangaroo Point

- Within 5km of major Olympic venues

Risk & Reward: The Balanced View

Brisbane Risks:

- Short-term supply spikes (post-2028)

- Competitive buyer pool

- Interest rate volatility

Mitigation:

- Buy in established areas, not speculative outer rings

- Focus on houses, not high-rise units

- Hold minimum 5–8 years for Olympics cycle

👉 Investor Takeaway: Brisbane offers high reward with manageable risk — especially when guided by expert buyer advocacy.

Final Verdict: The Smart Money’s Already in Brisbane

Brisbane isn’t just another growth city — it’s Australia’s next economic engine.

Between now and 2030, the city’s fundamentals — affordability, infrastructure, migration, and momentum — are set to outperform every other capital.

Melbourne still holds cultural and commercial value, but from a pure investment perspective, Brisbane wins decisively.

- Stronger growth

- Lower risk

- Bigger upside

Ready to Take Action?

The next 6–12 months are your entry window before Olympic-driven premiums fully price in.

Book your free 1:1 Strategy Session and we’ll map out your personalised Brisbane investment roadmap — from suburb selection to finance strategy and off-market access.

Because in property — timing is everything.

show less