Has Property Investing Become a Game Only for the Wealthy? Here’s the Truth for 2025

Let’s be honest — buying property in 2025 feels harder than ever.

Prices are high, interest rates have only recently started to ease, and borrowing power for most Australians has dropped by 25–30% since 2021.

So it’s no surprise that many first-time buyers and investors — especially migrants building their lives in Australia — are asking:

“Has property investing become a game only for the wealthy?”

The short answer: No.

While property is more expensive than it was a decade ago, the opportunities haven’t disappeared — they’ve simply shifted.

If you zoom out, you’ll see a very different story: a market full of micro-opportunities across many Australian sub-markets, each moving in its own rhythm. The real key is understanding where the smart money is moving — and why.

Read moreThe Myth of “One Market”

When Australians hear that “property is unaffordable,” we often assume that applies everywhere. But Australia doesn’t have oneproperty market — it has hundreds.

Each state, city, and suburb has its own ecosystem driven by:

- Supply and demand

- Infrastructure and job creation

- Demographics and migration

- Lifestyle appeal

- Affordability cycles

In short: what’s “unaffordable” in Sydney might still be perfectly attainable in places like Dubbo, Burnie, or Ballarat.

As a buyer’s agent, I’ve seen this firsthand — clients who felt priced out of Sydney’s $1.5M median suddenly realised they could secure a quality home or investment property in an emerging market for under $600K, often with better rental yield and growth prospects.

Australians See Different Growth Stories Across City Rings

To understand why opportunities still exist, let’s zoom into our capital cities.

Each city has three general “rings”:

- Inner suburbs: close to the CBD, established, high-value.

- Middle suburbs: family-friendly, strong amenities, mid-tier pricing.

- Outer suburbs: affordable, growing, newer developments.

These rings don’t move in sync — they respond to economic changes in very different ways.

2020–2022: The COVID Boom

During the pandemic, record-low interest rates and flexible work conditions drove a nationwide property surge. Inner and middle-ring suburbs in cities like Sydney and Brisbane saw some of the fastest growth, as buyers prioritised lifestyle and convenience over affordability.

- Sydney’s inner ring surged early — boosted by strong demand and limited stock.

- Brisbane’s middle ring recorded sharp price spikes thanks to migration and infrastructure momentum.

In this phase, affordability wasn’t the main driver — access and location were.

2022–2024: The Post-Boom Correction

Then came rising interest rates. Borrowing power fell, and suddenly, affordability mattered again.

Buyers began shifting outward — and the outer-ring suburbs took the spotlight.

In cities like Adelaide and Perth, fringe markets experienced some of the fastest growth in the nation. These were suburbs where a detached home under $600K was still attainable, making them magnets for both first-home buyers and affordability-driven investors.

For example:

- Perth’s outer south and north grew by double digits as affordability tightened elsewhere.

- Adelaide’s fringe suburbs became the growth engines, outperforming inner areas for two consecutive years.

2025: The Pendulum Swings Back

Now, with interest rate cuts on the horizon and confidence slowly returning, we’re seeing the pendulum swing again.

Borrowing power is improving, and outer suburb affordability is fading.

That’s bringing renewed demand into inner and middle rings — especially in markets like Melbourne and Adelaide, where prices have stabilised and infrastructure pipelines are strong.

This cyclical shift reinforces one key truth:

Even within a single city, not all markets move together — and timing + location are everything.

What This Means for Australians Looking to Buy or Invest

If you’re a home buyer or investor, this cycle holds a powerful lesson:

It’s not about whether property is “too expensive.” It’s about where it’s expensive — and where value still exists.

Let’s put it in perspective:

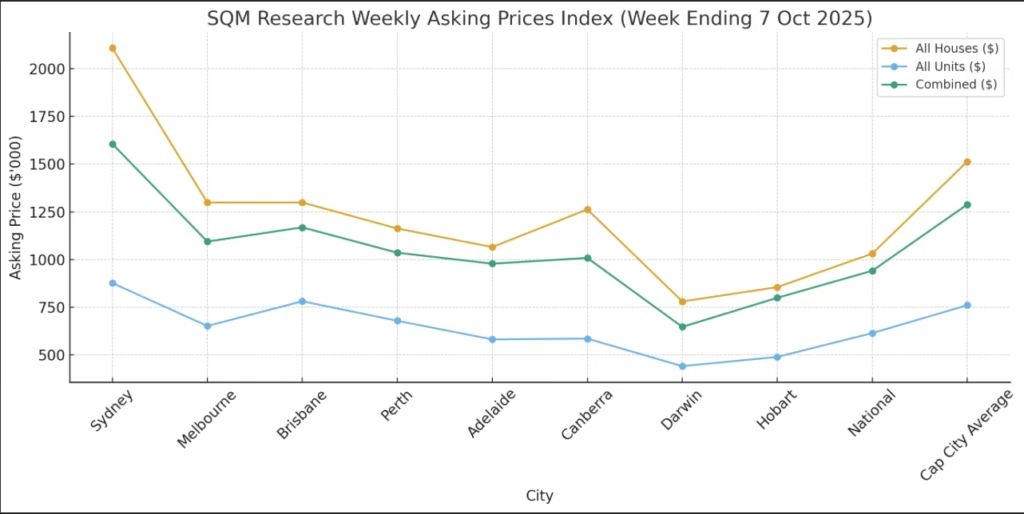

| City | Median House Price (Sep 2025) | Comment |

|---|---|---|

| Sydney | $1.52M | Limited entry points under $1M |

| Canberra | $990K | Stable but stretched |

| Dubbo (NSW) | $530K | Affordable regional hub |

| Ballarat (VIC) | $580K | Strong rental demand |

| Burnie (TAS) | $460K | Rising migration interest |

| Devonport (TAS) | $480K | Strong yields, low vacancy |

With a borrowing capacity of $900K, you might only afford one property in Sydney — but you could comfortably buy two in strong-performing regional markets like Ballarat or Dubbo, each with positive cash flow potential.

That’s what smart investors are doing in 2025 — strategically diversifying into affordable growth pockets that balance rental yield and capital growth.

Australians Are Learning to Look Beyond Headlines

Media narratives often simplify property into a single storyline:

“Prices up, prices down, affordability worsens.”

But reality is far more nuanced. Even during downturns, some suburbs experience growth due to:

- Infrastructure completions

- Lifestyle migration

- Supply shortages

- Strong rental yield differentials

These micro-trends are where opportunities hide.

As a buyer’s agent, my team and I focus on uncovering these trends — analysing not just what the data says, but whycertain markets outperform others. Because in property, context is everything.

How Australians Can Still Build Wealth Through Property

The good news?

Today’s buyers have access to more data, tools, and professional insights than ever before. What once took weeks of research can now be uncovered through precise, data-backed analysis and on-ground expertise.

That’s where strategies like The CLEAR Strategy™ come in — helping buyers:

- Identify markets that align with their borrowing power.

- Filter suburbs based on growth potential, rental yield, and future infrastructure.

- Execute a plan that builds both equity and cash flow — not just one or the other.

Because the goal isn’t to buy what’s popular — it’s to buy what’s strategic.

The New Rules of Smart Property Investing (2025–2030)

Here’s what separates successful investors in this cycle:

1. Follow Affordability Migration

Track where affordability is driving buyers. When first-home buyers migrate to outer or regional areas, prices follow.

2. Time the Market Rings

Each suburb ring (inner, middle, outer) operates on a cycle. Understand when each ring is entering recovery — and position early.

3. Think in Portfolios, Not Properties

Start with one, but plan for two or three over the next five years. Using only part of your borrowing power (like I did — 60%) leaves room for future leverage.

4. Diversify Geographically

Don’t tie all your assets to one city. Spread across states or regions to balance growth and yield exposure.

5. Invest with Fundamentals, Not Fear

Avoid emotional buying. Focus on suburbs with:

- Low vacancy rates

- Strong job nodes

- New infrastructure

- Rising population inflows

Conclusion: It’s Not About Being Rich — It’s About Being Ready

Yes, property prices are higher today. But the idea that investing is only for the wealthy is a myth.

The Australian property market is not one giant, inaccessible system — it’s a mosaic of opportunities waiting for those who know where to look.

With the right strategy, you can still build wealth and stability through property — even in 2025’s challenging landscape.

If you’re ready to find the right property, in the right market, at the right time, let’s talk.

💬 Book your free strategy session with us, and let’s map your path from uncertainty to opportunity.